Notification GSR 976E Ministry of Labour and Employment October 7 2016 Notification GSR 235E Ministry of Labour and Employment March 16 2018. 12 of BASIC DA.

Basics And Contribution Rate Of Epf Eps Edli Calculation

Chetan on March 21 2018 at 402 PM How to link PAN with epf My aadhar is already link with epf.

. Employer contribution will be split as. Together the 27 Members of the College are the Commissions political leadership during a 5-year term. Table of Contents.

This static currency converter provides the European Commissions official monthly accounting rate for the euro and the conversion rates as established by the Accounting Officer of the European Commission in line with article 19 of the Financial Regulation. Employer contribution will be split as. 050 wef 01062018 EDLIS Charges.

The 2020 Bill defines a worker as any person who work for hire or reward. EPS contribution will be a maximum of 1250. There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022.

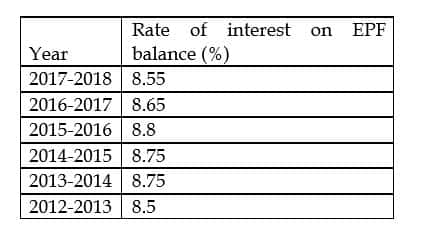

As of now the EPF interest rate is 850 FY 2019-20. Hope the above helps. EPF Interest Rate.

EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000. EPF Contribution Third Schedule. Bifurcations of Contribution.

EPF contributions for both employee and employer is calculated on the basis of your BASICDA ie. Learn all about EPF Self Contribution and the many benefits of this voluntary scheme including receiving EPF dividends and income tax relief. 01042017 The employer is required to pay his contribution and deduct employees contribution from wages and deposit the same with ESIC.

This amount BASIC DA is capped at INR 15000. 050 EPF Admin Charges. The Commission is composed of the College of Commissioners from 27 EU countries.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. PART II THE BOARD AND THE INVESTMENT PANEL. Any extra contribution will go into EPF.

Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until the year 2022. Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. Industrial Disputes Act 1947.

SIP EIS Table. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and. But this rate is revised every year.

833 of employer contribution. The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20. EPF contribution for both employee and employer is calculated on the basis of your BASICDA ie.

Examples of Allowable Deduction are. EPF EPS Difference Remitted. Contract Labour Act 1970.

Generally it 367 of employer contribution towards PF when the basic wage of an employee is greater than 15000 then it will automatically calculate the PF contribution of employer. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. February 1 2018 at 1040 am.

In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution. Read about how Sukanya Samriddhi Yojana calculator works its advantages and its disadvantages before opening a sukanya samriddhi account. Establishment of the Board.

Jadual PCB 2020 PCB Table 2018. 12 of employee contribution. The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May.

Once there is a contribution by an employer PANBank Details would be allowed as they have to be verified and approved by the employer. How to calculate Tax on EPF Interest above 25 lakhs With. In other words if your BASIC DA exceeds INR 15000 the maximum EPF contribution will not exceed INR 1250.

367 Difference of ee share and Pension Contribution EPS EDLI. In other words if your BASIC DA exceeds INR 15000 the maximum EPF contribution will not exceed INR 1250. Certain terms not defined in the Code.

Details will be updated by 28-03-2018. 12 of BASIC DA. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and.

This amount BASIC DA is capped at INR 15000. The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance. The income tax slabs and rates have been kept unchanged since financial year FY 2020-21.

Download Kwsp Rate 2020 Table Background Kwspblogs

Epf Contribution Rate Table Urijahct

Download Employee Kwsp Contribution Pics Kwspblogs

20 Kwsp 7 Contribution Rate Png Kwspblogs

Download Kwsp Rate 2020 Table Background Kwspblogs

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Interest Rate From 1952 And Epfo

Number Of Active Epf Members And Contributions Download Table

Epf Interest Rate From 1952 And Epfo

Epf Contribution Rates 1952 2009 Download Table

What Is The Epf Contribution Rate Table Wisdom Jobs India

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Basic Savings Table Epf For Unit Trust Consultant 2018 Myunittrust Com

Epf Contribution Rate Table Urijahct

How Epf Employees Provident Fund Interest Is Calculated

Does Interest Rate Increase Make Epf An Attractive Investment Option

Epf A C Interest Calculation Components Example

Epf Contribution Rates 1952 2009 Download Table